At this late stage in the tax season, it is always easier when a tax preparer receives an organized file of your income tax information. Have your W-2s clipped together and any 1099s from investment/interest income also clipped separately. If you are in business for yourself make a listing of grand totals for Gross Income (Sales) and each of your known expenses such as: purchases, office supplies, website-Internet, professional liability insurance, advertising, etc. You may have been issued 1099-NEC which reflects your self-employment income. The preparer will need those forms.Remember the tax preparer is accepting your information and totals, he/she is not auditing your figures.

Now comes the ‘fun’ part – putting together your possible deductible expenses. If you pay home mortgage interest you should have received the form 1098 from your mortgage company(s). In addition don’t forget your real estate taxes; in some cases the taxes are remitted via the mortgage escrow, if so this will be reflected on your form 1098 too. A listing of any contributions made to charitable organizations can help to add to your totals. Medical expenses should include not only doctor/dentists paid by you after insurance, but also health insurance and long term care insurance premiums. If you are on Medicare it is considered a form of health insurance. Other items can include hearing aids, prescription medication, medical assistance devices, glasses and contacts. Remember each year stands on its own. Some years you may have enough medical expenses to deduct while other years possibly not. Your total medical expenses have to be greater than 7.5% of your Gross Income to qualify.

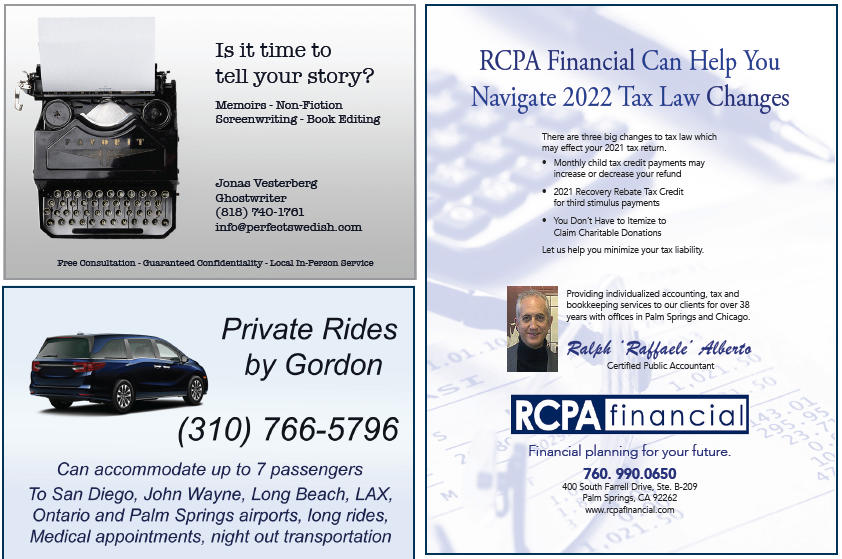

We are able to assist you in organizing and helping you determine the best possible course of action for your tax filings, not only for the current year, but also to possibly review prior year filings for any issues, and going forward with your filing needs.

Contact Ralph ‘Raffaele’ Alberto by calling the RCPA Financial office at 760-990-0650. The RCPA office is open Monday through Friday from 9-5 and is located at 400 S Farrell Dr Ste B-209 Palm Springs, CA 92262.