As we get closer to the holiday season and the end of 2022, many taxpayers are trying to find ways to take advantage of tax benefits that may be available to them. One benefit that retirees constantly overlook is the Qualified Charitable Distribution, also known as a QCD.

A QCD is a distribution from your IRA that is paid directly to your qualified charity of choice. This will lower your Adjusted Gross Income directly vs. distributing the funds to charity from your bank account and hoping that you can itemize deductions when you file your tax return the following year.

Many retirees have an RMD (Required Minimum Distribution) requirement to withdraw a certain amount of money from their retirement accounts and a QCD satisfies that requirement, excluding the amount from their income while also allowing them to give to the charities of their choice.

Taxpayers don’t have to itemize in order to take advantage of QCDs and may save money by lowering the income tax on their Social Security benefits.

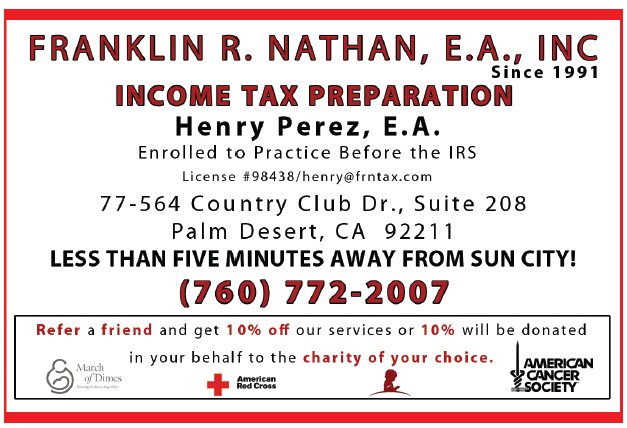

Enrique Perez, E.A. (Enrolled Agent) is a federally authorized tax advisor and practitioner empowered by the U.S. Department of the Treasury. He represents taxpayers before the Internal Revenue Service (IRS) for tax issues that include audits, collections, and appeals.

SERVICES: Tax Preparation for Individuals, Trusts, Corporations, LLCs and Partnerships, Bookkeeping Services, Payroll Services, Tax Resolution Services, Audits, and Notary Public Services.

For more information on QCDs, Enrique Perez, E.A. can be contacted at (760) 772-2007